OR DoR OR-40 2015 free printable template

Show details

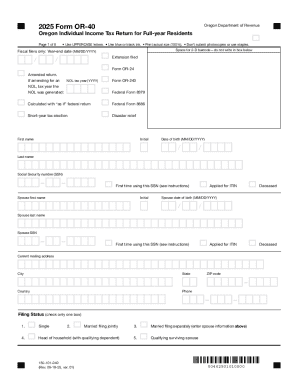

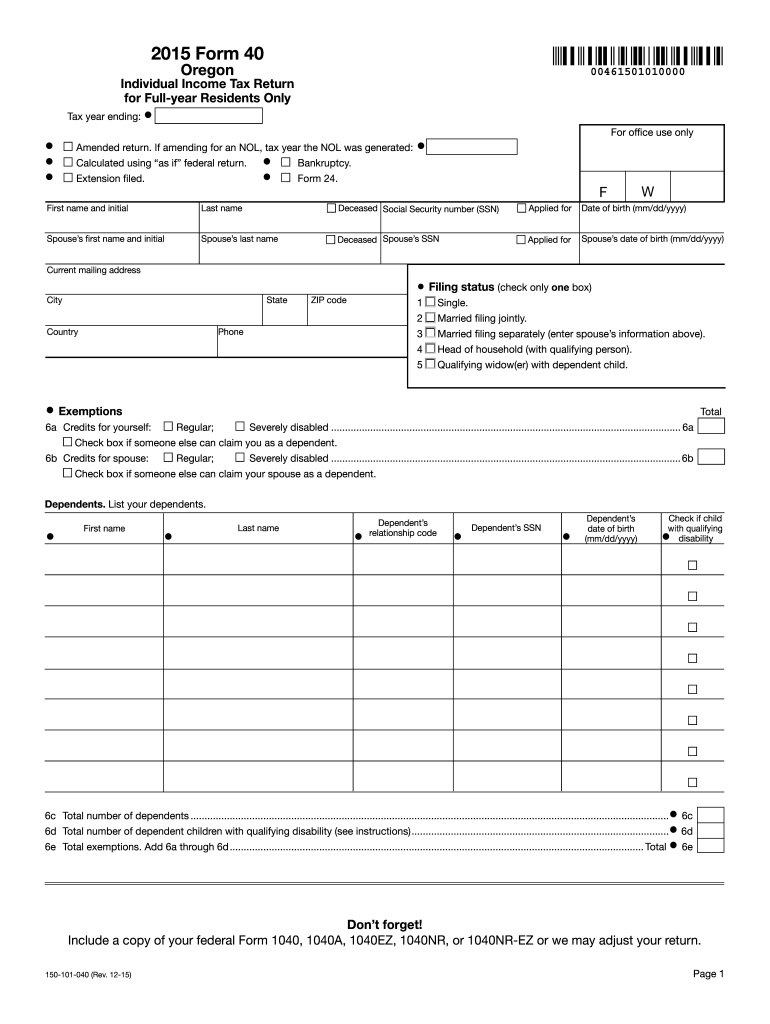

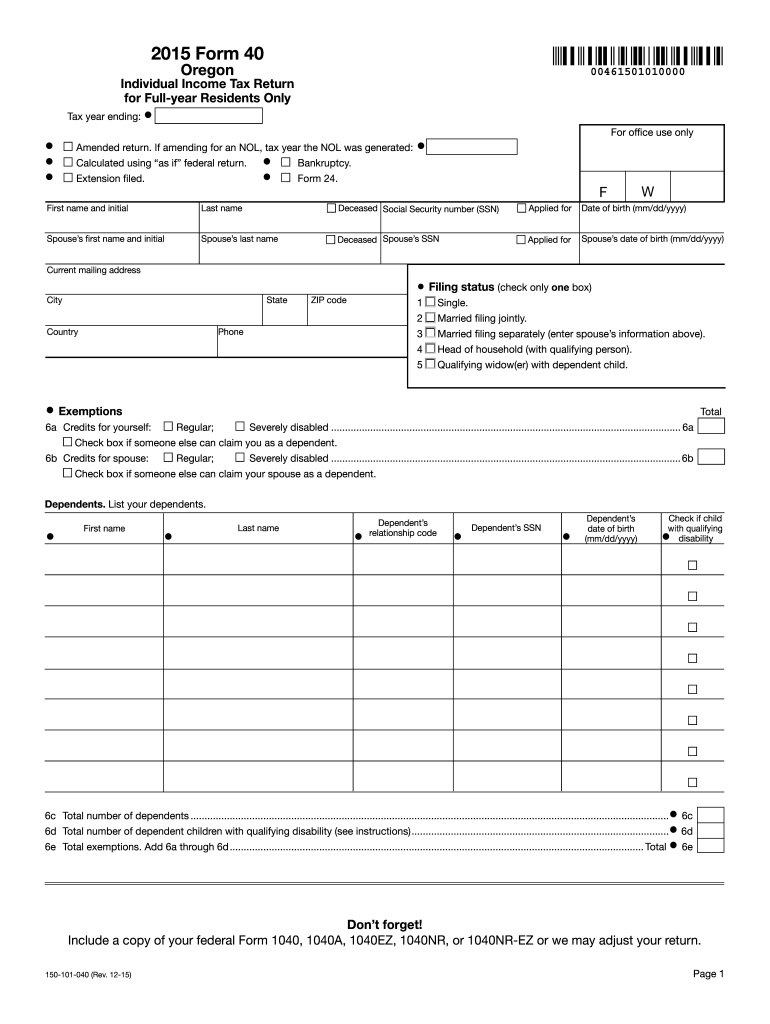

Write your daytime phone number and 2015 Oregon Form 40 on your check or money order. Include your payment along with the payment voucher with this return. Mail tax-due returns to Oregon Department of Revenue PO Box 14555 Salem OR 97309-0940. Clear form 2015 Form 40 Oregon 00461501010000 Individual Income Tax Return for Full-year Residents Only Tax year ending Amended return. If amending for an NOL tax year the NOL was generated Calculated using as if federal return. Bankruptcy. 21 Oregon...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR DoR OR-40

Edit your OR DoR OR-40 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR DoR OR-40 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OR DoR OR-40 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OR DoR OR-40. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR DoR OR-40 Form Versions

Version

Form Popularity

Fillable & printabley

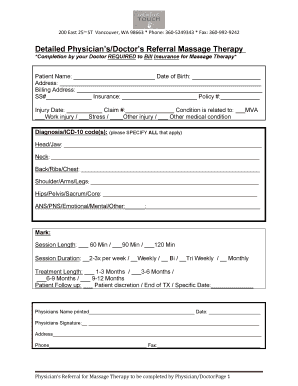

How to fill out OR DoR OR-40

How to fill out OR DoR OR-40

01

Gather all necessary documentation, including income statements and any deductions.

02

Start with the top section of the OR DoR OR-40 form and enter your personal information, including your name and address.

03

Fill in your filing status (e.g., single, married) as applicable.

04

Report your total income by summing up all income sources and entering the amount in the appropriate section.

05

Subtract allowable deductions from your total income to calculate your taxable income.

06

Use the tax tables provided to determine the amount of tax owed based on your taxable income.

07

Complete any additional sections relevant to tax credits or other adjustments.

08

Review the completed form for accuracy before signing and dating it.

09

Submit the form by the deadline, either electronically or via mail.

Who needs OR DoR OR-40?

01

Residents of Oregon who have earned income and need to file a state income tax return.

02

Individuals seeking to claim deductions, credits, or any tax refunds related to their income.

03

Anyone who meets the filing requirements based on income thresholds set by the Oregon Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

How is Oregon income tax calculated?

It consists of four income tax brackets, with rates increasing from 4.75% to a top rate of 9.9%. That top marginal rate is one of the highest rates in the country.Income Tax Brackets. Married, Filing SeparatelyOregon Taxable IncomeRate$0 - $3,6504.75%$3,650 - $9,2006.75%$9,200 - $125,0008.75%1 more row • Dec 23, 2021

How do I get my Oregon 1095 A?

The fastest way to get a copy is to call us. You can also send an email or mail us a letter. Call us at 844-346-8060 and ask for a copy. Send a secure email to 1095B.Requests@dhsoha.state.or.us.

What is a 10/40 form used for?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is Oregon income tax?

How does Oregon's tax code compare? Oregon has a graduated individual income tax, with rates ranging from 4.75 percent to 9.90 percent. There are also jurisdictions that collect local income taxes. Oregon has a 6.60 percent to 7.60 percent corporate income tax rate and levies a gross receipts tax.

Do I need to file Oregon state tax return?

For Oregon Residents: If your gross income is greater than the amount corresponding to your filing status and boxes checked, you are required to file an Oregon state tax return. Note: If you are being claimed as a dependent on another taxpayer's return, your filing threshold is $1,150.

How much tax does Oregon take out of my paycheck?

The state uses a four-bracket progressive state income tax, which means that higher income levels correspond to higher state income tax rates. These rates range from 4.75% to 9.90%. For 2021, that's the fourth-highest top rate in the country.

Where is taxable income on 1040?

For tax year 2022, your AGI is on Line 11 on Form 1040, 1040-SR, and 1040NR. It is located on different lines on forms from earlier years. Your AGI often impacts the tax breaks you're eligible for.

Can I find my tax forms online?

Access Tax Records in Online Account You can view your tax records now in your Online Account. This is the fastest, easiest way to: Find out how much you owe.

Does Oregon have a state tax ID?

Your business ID number (BIN) in Oregon is essentially your state tax ID number. It's another unique, identifying number, but one assigned at the state level when you register your business with the state government.

What form do I use to file my Oregon state taxes?

You can use a tax preparer, Oregon-approved software, or a free e-filing service. These are the steps of the process: Once completed, your federal and state returns are signed with a federal PIN or Oregon Form EF.

What is Oregon income tax rate 2022?

Withholding Formula >(Oregon Effective 2022)< Single (With Less Than Three Exemptions)If the Amount of Taxable Income Is:The Amount of Oregon Tax Withholding Should Be:$ 0$ 3,7504.75%3,7509,4506.75%9,450and over8.75%1 more row

Are Oregon taxes high?

Oregon is the only state that lands on the top five lists in all three categories we looked at here: top income tax rates, middle class income tax rates and income tax collection per capita. Middle class tax rate: 7.8 percent. Idaho ranks twelfth highest among states levying an individual income tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OR DoR OR-40 for eSignature?

To distribute your OR DoR OR-40, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make edits in OR DoR OR-40 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing OR DoR OR-40 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I fill out OR DoR OR-40 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your OR DoR OR-40 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is OR DoR OR-40?

OR DoR OR-40 is the state of Oregon's individual income tax return form used for reporting personal income to the Oregon Department of Revenue.

Who is required to file OR DoR OR-40?

Individuals who are residents of Oregon and have taxable income must file OR DoR OR-40, as well as part-year residents and non-residents who have income sourced from Oregon.

How to fill out OR DoR OR-40?

To fill out OR DoR OR-40, taxpayers must provide personal information, report their income, claim deductions and credits, and calculate their tax liability before submitting the form to the Oregon Department of Revenue.

What is the purpose of OR DoR OR-40?

The purpose of OR DoR OR-40 is to assess and collect income taxes from residents and other individuals who earn income in Oregon, enabling the state to fund public services.

What information must be reported on OR DoR OR-40?

Taxpayers must report their total income, adjustments, deductions, credits, and any taxes paid, in addition to providing identifying information such as Social Security numbers and filing status.

Fill out your OR DoR OR-40 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR DoR OR-40 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.